Author: Corporate Nigeria defies high interest rates with N1.6 trillion CP issuances in 2025. Posted On: 20 hours ago

Author: Corporate Nigeria defies high interest rates with N1.6 trillion CP issuances in 2025. Posted On: 20 hours ago

Blog Category: Academics

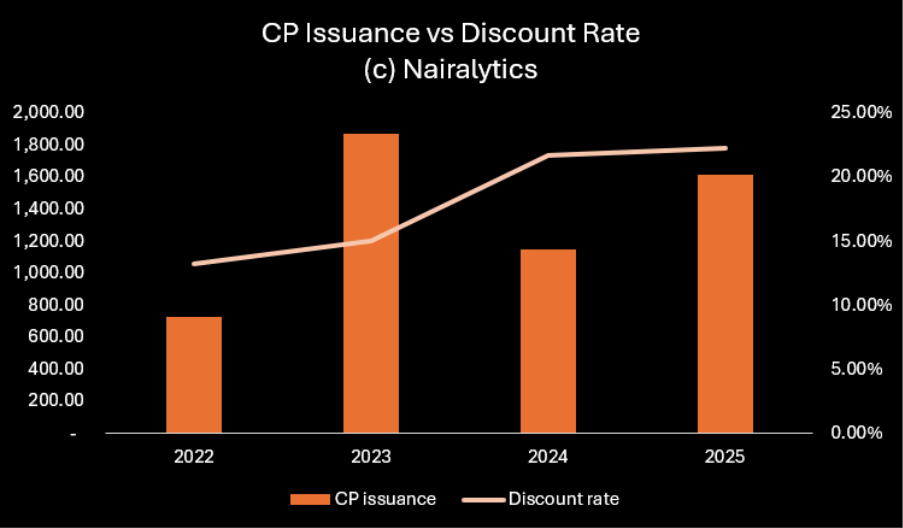

Despite a restrictive monetary environment and historically high borrowing costs, Nigerian corporates raised a total of N1.61 trillion in commercial papers (CPs) from the capital market in 2025.

This represents a 40% increase compared to the N1.15 trillion recorded in the previous year.

This is according to data compiled by Nairametrics Research from FMDQ.

The surge in CP issuances occurred against the backdrop of a high-interest-rate regime, following the CBN’s aggressive monetary tightening cycle in 2024 aimed at curbing inflation and stabilizing the naira.

With bank lending rates elevated and liquidity conditions relatively tight, many corporates found traditional bank financing either costly or constrained, prompting greater reliance on capital market-based funding solutions.

According to the FMDQ, the average discount rate for the CPs rose to 22.38% with an average tenor of 233 days, compared to 21.69% in 225 days in the previous year.

It is worth noting that 2025 witnessed the highest rate in recent history.

This is partly due to CBN’s wait-and-see approach of interest rates relatively high for most part of the year, with just a 50bps rate cut in Q3, thereby leaving borrowing cost at a high level.

Commercial paper, which typically offers faster execution, flexibility, and less stringent documentation requirements compared to bank loans, emerged as an attractive alternative for corporates seeking working capital, trade financing, and short-term liquidity support.

The increase in issuance suggests that firms were willing to absorb higher financing costs in exchange for timely access to funds.

The increase in the average tenor also indicates that firms were slightly more comfortable extending their short-term funding horizon despite the elevated cost of borrowing.

This may also suggest improved investor confidence in corporate credit profiles and greater demand for higher-yielding short-term instruments.

In an interview with Victor Onyema, Head of Investments at Norrenberger Asset Management Limited, he noted that corporates who rely on external financing for working capital are finding their funding choices increasingly constrained, compelling many to turn to the capital market, particularly short-term instruments such as commercial papers.

0 comment(s)

Leave a Comment