Blog Category: Academics

In a direct response to the liquidity crisis in our market, the SEC has triggered its Capital Market Working Group to examine the issue closely.

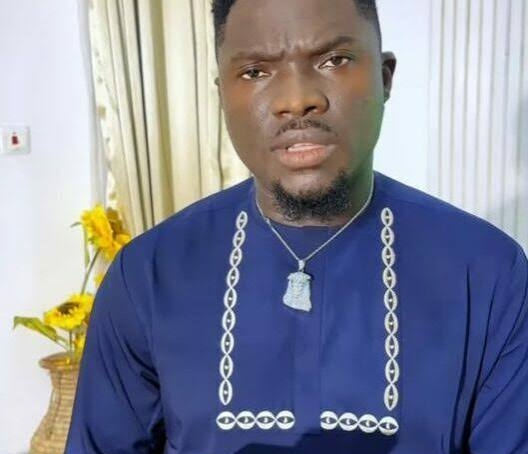

In an address by the Director-General of the SEC, Dr. Emomotimi Agama, seen by me, the highly responsive regulator outlined very clear terms of reference for the mandated group:

You will recall that last month, I cried out like one in the wilderness that the paucity of tradable instruments in our equity market was, among other things, diminishing its importance.

When only five major stocks control the ASI, and less than 10% of those stocks are available on the open market for trading, it undermines the rampaging ASI, which crossed the N100 trillion mark early this year and has since been hurtling forward like a jet-powered engine.

Dr. Agama, who is increasingly becoming one of my favourite personalities in the capital market, placed a call to me.

During that call, he spoke about the Liquidity Committee. He also mentioned all they have been doing at the SEC, including sanctions, to ameliorate the situation, and assured me that the issue would be tackled with precision.

I had no reason to doubt his resolve and capacity to confront this issue, following my historic one-hour sit-down with him at his expansive office in Abuja.

In that meeting, he came across as a robust tactician who clearly understands not only Nigerians’ expectations of him in this role, but also possesses the capacity to deliver.

My confidence in the SEC’s ability under his leadership has once again been strengthened by this speech sent to me as a critical observer of our markets.

Once this issue is resolved and we achieve at least another 10% at a minimum, attaining equilibrium in trading will become easier. This would boost transparency and confidence and draw more participants into the market.

It is at that point that we can truly celebrate a supercharged ASI, because then we can genuinely say we have one of the best-performing markets on earth, unlike now, when it is largely paper gains we are counting.

I wish the Committee well. I wish the SEC well.

And I also want to stick out my tongue at those elements within the market who, lacking the gumption to confront this issue, chose instead to respond with insidious insinuations rather than stand behind me as I push for reform.

Thankfully, the market is in good hands, and Nigerians will be better for it.

Thanks.

Come and beat me.

Duke of Shomolu

0 comment(s)

Leave a Comment